maryland digital advertising tax effective date

He said at the time that it would be unconscionable to raise taxes and fees during a global pandemic and. Of February 12 2021 is later than the effective date of July 1 2020 HB 732 now becomes effective March 14 2021 and appl ies to taxable years beginning after December 31 2020.

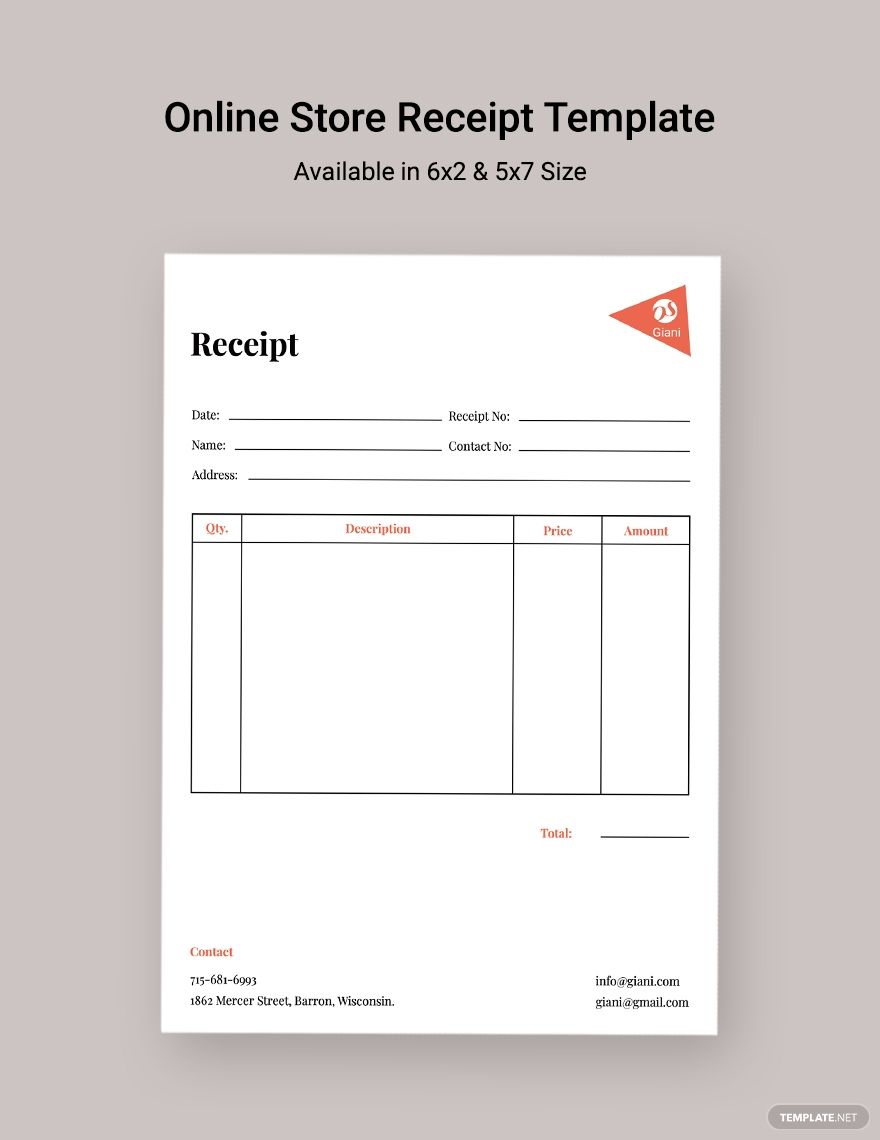

Online Store Receipt Template Google Docs Google Sheets Illustrator Indesign Word Apple Pages Psd Publisher Template Net Receipt Template Online Store Receipt

787 which makes changes to the Digital Advertising Gross Revenue Tax including moving the effective date to tax years beginning after December 31 2021 as well as a provision that prevents the tax.

. Maryland has now enacted the nations first gross receipts tax targeted on digital advertising. Marylands new tax is a law and it will be implemented. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax.

Although the effective date listed in HB 932 is 1 July 2020 the new law will take effect from 15 March 2021. The state Senate Monday overwhelmingly passed SB. This amendment would not delay the effective date of the tax it only changes the applicable tax year 2021 to 2022.

Effective for tax year 2021 HB 732 imposes a tax on the annual gross revenue derived from digital advertising in the state. The first bill HB. 732 2020 the Maryland Senate on February 12 2021 passed the nations.

A number of legal concerns have been raised about the validity of Maryland. A bill that would amend. Digital Products and Digital Codes The new legislation excludes certain prerecorded and live instruction seminars discussions or similar events from the definition of a digital product.

12 2021 Marylands General Assembly enacted two bills over the veto of Gov. March 01 2021 Updated April 29 2021 Update The Maryland legislature passed SB. Overriding the governors veto of HB.

Marylands Digital Advertising Gross Revenues Tax HB 732 was voted into law by the states General Assembly on Feb. On February 12 2021 Marylands General Assembly enacted two bills over the veto of Gov. The tax is applicable to all taxable years beginning after December 31 2020.

932 expands the existing sales and use tax base to include digital products effective March 14 2021. Larry Hogan that make major changes in the states tax code. 105-277 and the US.

Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital. Wednesday March 17 2021. The first bill HB.

One is a sales tax on digital products and the other is a digital advertising tax. At that date the sales and use tax rate on a sale of a digital product or a digital code is 6. It is scheduled to take effect by March 14 and that seems unlikely to change as of today.

Accordingly the digital advertising services tax measures are enacted and effective for tax years beginning after December 31 2020. Legal challenges have already been filed alleging that the new tax violates the federal Internet Tax Freedom Act PL. The Maryland Legislature has adopted the first digital advertising tax in the nation.

The tax is applicable to all taxable years beginning after December 31 2020. Digital products including software-as-a-service are subject to Maryland sales tax as of March 14 2021. The Comptroller of Maryland does not expect to issue additional guidance for the digital advertising services tax until at least July 2021.

932 expands the existing sales and use tax base to include digital products effective March 14 2021. The tax on digital advertising services also takes effect March 14 and applies to all taxable years beginning after December 31 2020 but lawmakers are considering a measure SB 787 that would push the effective date back to January 1 2022. The tax only applies to companies having annual gross revenues without deduction.

732 imposes a tax on a persons annual gross revenues derived from digital advertising services in Maryland. Marylands legislature on February 12 2021 voted to override the governors veto of legislation imposing a new tax on digital advertising. The first estimated quarterly payment at least 25 of.

Tax on digital advertising. Lawmakers approved House Bill 732 in March 2020 but Governor Larry Hogan vetoed it. Larry Hogan that make major changes in the states tax code.

Its expected to generate 250 million in its first year. Key aspects of Marylands new tax The newly enacted tax law defines digital advertising services to. One is a sales tax on digital products and the other is a digital advertisingtax.

Three Issues with Proposed Regulations for Marylands Digital Advertising Tax. 1 This tax which is intended to be imposed on the annual gross receipts derived from certain digital advertising services provided in Maryland became effective on Jan. The first estimated quarterly payment at least 25 of the reasonably estimated tax based on 2021 Maryland digital ad tax revenues.

On February 12 2021 the Maryland General Assembly overrode Governor Larry Hogans veto of HB 732 2020 the Act a bill enacting a first-of-its-kind digital advertising services tax on the annual gross receipts from the provision of digital advertising services in Maryland. This alert is updated to reflect the March 15 2021 effective date for HB 932 which expands the states sales tax base to certain digital goods. As mandated by the Maryland Constitution the tax will take effect in 30 days.

This tax tip has been revised in. 2 The regulations provide a set of rules for sourcing digital. Effective for tax years beginning after Dec.

Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country. Tax on digital advertising services is enacted. On February 12 2021 the Maryland legislature overrode Maryland Governor Larry Hogans vetoes of HB 732 which imposes a new tax on digital advertising and HB 932 which extends the states existing sales and use tax to the sale of.

Maryland Passes Digital Advertising Tax Now Being Challenged in Court. But legislators punted several crucial questions to the state comptroller who. Business Tax Tip 29 Sales of Digital Products and Digital Codes was originally published on March 9 2021.

787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue of internet advertising giants such as Google and Facebook Inc.

Infographic 6 Habits Of Productive Accountants Accounting Career Accounting Infographic

Everything As A Service Modernizing The Core Through A Services Lens Figure 1 Redesigning Business Proce Business Process Deloitte University Legacy System

Expense Tracker Business Expense Tracking Overhead Expense Etsy Business Expense Business Expense Tracker Expense Tracker

Creative Brief Workshop Brief Workshop Creative

Small Business Planner Small Business Printable Planner Etsy Business Plan Template Small Business Planner Business Plan Template Free

Today Is National Lost Sock Memorial Day A Day To Honor All Of The Socks That Have Been Lost Over The Years On Th Lost Socks Medical Marketing Memorial Day

Free Model Management Contract Template Contract Template Advertising Agency Ad Agency

You Want To Increase Your Instagram Reach Follow This Steps Follow Busines Online Business Marketing Best Online Business Ideas Small Business Success

Cost Benefit Analysis Excel Template Awesome 41 Free Cost Benefit Analysis Templates Examples Free Analysis Business Template Business Case

Customer Proposal Template Marketing Proposal Proposal Templates Proposal

Ultimate 2017 Marketing Planning Calendar Vandenberg Web Creative Marketing Planning Calendar Marketing Plan Planning Calendar

Product Sales Invoice Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Invoice Template Invoice Design Template Invoicing

Network Marketing Ideas For Offline Advertising Network Marketing Marketing Business

Farm Inventory Instant Digital Download Editable Farm Etsy Farm Management Cash Crop

Clickbank Secrets A Profitable Native Ads Affiliate Marketing Case Study Marketing Case Study Affiliate Marketing Case Study

Customer Contact Follow Up Sheet Small Business Bookkeeping Business Printables Small Business Organization

Monthly Expense Report Template Profit Loss Report Spreadsheet Demo Looking For A Business Budget Template Excel Templates Business Small Business Expenses